The Dollar’s Rise in the Face of “Quitaly” Threatens the U.S. Economy

A popular saying implies that more is not necessarily better. It may appear counter-intuitive, but the fast-rising dollar may not be as good an omen for the U.S. economy as it appears at first glance.

A high dollar poses significant hazards.

That’s why President Donald Trump likes to accuse the United States’ main competitors, China and Germany, of purposely undervaluing their currencies to facilitate trade.

Many have discussed the possibility that the Federal Reserve would raise interest rates four times.

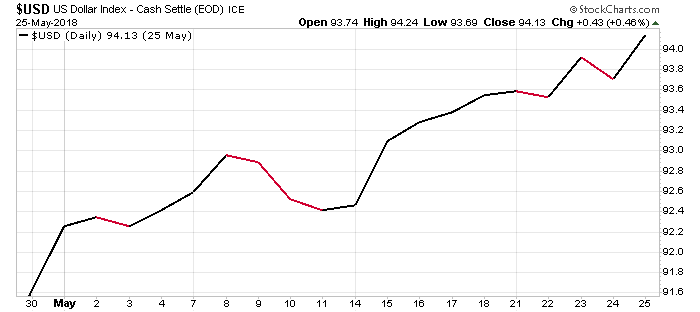

Fed Chair Jerome Powell said he would only raise rates three times. And this has sent the U.S. dollar index surging over the past year, as the chart below shows.

Chart courtesy of StockCharts.com

Those Who Thought the Euro Would Suffer Were Mistaken

Now, the Fed must confront an unexpected problem. In fact, it’s not all that unexpected. Many analysts expected the euro to suffer in 2018 because of a series of elections.

In particular, the Italian election, held in March 2018, has yielded results far worse than the worst expectations.

Such is the worry of a potential Italian move out of the EU that many are using a newly minted term: “Quitaly,” an obvious homage to, and variation of, the term “Brexit.”

As a result, the euro has taken a beating and the dollar has been rising far beyond anything the Federal Reserve had planned.

In other words, the dollar is out of control. And this time, Trump can’t blame Germany of having manipulated the currency.

In general, successive administrations in Washington have tried to contain, or at least control, the appreciation of the dollar. But Trump has found stormier waters to navigate (no pun intended).

U.S. Growth Has Failed Expectations

Trump promised the U.S. economy would be growing at least three percent per year. Most economists expect the peak, marked by a growth domestic product (GDP) growth rate of roughly that percentage, to have come and gone.

As it happens in the first quarter of 2018, the U.S. economy was growing at about 2.3%. That’s far below Trump’s most pessimistic targets.

And now, the dollar has slipped out of the Fed’s control like a runaway drone.

Weren’t the tax cuts announced just before Christmas 2017 supposed to boost and inject liquidity into the general economy (and not just in the financial markets)?

Even those who believe in the tale that the tax cuts will start producing favorable effects later in the year could not have predicted the risks that could impact U.S. economic growth.

The Italian Election and “Quitaly”

And, yet, some risks were evident. Indeed, the problems that the Italian election has exacerbated were always there. It wasn’t even a “black swan” event.

The dollar is moving too high and too quickly to sustain that rate. The various trade hostilities that Trump has launched—barely short of trade wars—won’t help.

The White House faces obstacles of reciprocity and an overly expensive dollar now, pricing U.S. goods out of most markets. Instead, the Federal Reserve and Wall Street analysts have been harping on about the problem of inflation.

A problem that, given effectively stagnant wages that are barely starting to catch up to the pre-2008 financial crisis era, hardly deserves mention.

The Fed Has Lost Control of the Dollar

In this context, therefore, the dollar’s uncontrolled appreciation has highlighted the futility of Trump’s growth expectations.

As the Fed has already ended the fiscal stimulus to the markets in the form of ultra-low interest rates, the risk is that the strong dollar will slow GDP and trigger a market collapse.

Moreover, the euro’s current weakness is as far out of control as is the dollar’s strength. In other words, nice words, political concessions, and interest rates will not be able to bring down the dollar.

The European Central Bank (ECB) cannot control the euro’s weakness. The Italian election results have demonstrated that the effects of the 2008 financial crisis linger.

The Italian economy—the third-largest in the EU—still needs fiscal stimuli. And so do several other EU member states.

No Relief for the Dollar From the European Central Bank

Thus, President of the ECB Mario Draghi will continue to buy bonds and keep interest rates as close to zero as possible. The EU cannot yet allow higher interest rates to peak.

Trump may try to attribute the euro’s weakness to a presumed ECB’s intent to achieve an unfair competitive advantage for European exports to the U.S. market.

The cause is the continued need for expansionary monetary policies and a virtual admission that the EU economy needs more nursing. If America is already complaining about inflation, the EU has not yet achieved the same “luxury.”

As the market and geopolitical situations stand now, the dollar can expect to make further gains against the euro. It’s almost as if Jerome Powell should cut interest rates to slow down the dollar’s course.

The European markets have demonstrated the full uncertainty that Italy’s political situation has created.

And while the president of the Italian Republic, Sergio Mattarella, wanted to find a prompt solution, the two improbable allies of a ruling coalition decided at the last minute to concede some of their conditions.

Thus, Italy is left without a government appointed solely to guide it through the next G7 Summit and the next elections.

It’s Not Just Italy—the Euro Disease Will Infect All Member States

Still, it matters little, which government is formed.

There is a cancer in the European Union. Every election, whether in Italy, Spain, France, or even Germany will force parties and voters to dance around the problem of the euro.

And the problem of the euro in Italy as elsewhere, especially southern Europe, is a problem of rampant neo-liberalism.

Wrongly—or more probably, correctly—years of economic and financial rules imposed from Brussels—and by dutiful servants in Rome—have broken the social and economic fabric of Italian towns.

These were home to large and small companies that worked together more than compete, employing thousands and spreading the wealth.

The issue of the euro and the economic sacrifices it has implied—along with the entrepreneurial class, moving jobs abroad—will not go away.

The time has come to confront the euro head-on.

There’s no more room left for half-hearted or furtive attempts such as those made by a series of parties. Like it or not, in Italy, and elsewhere, no party will secure a decisive win without openly tackling the euro and proposing solutions.

Either the rules for adherence to the European Monetary System change or all member states, one by one, will experience the disintegration of their political systems.

Spain Could Be Next

And so long as this dance continues—speeding the tempo—the Federal Reserve will have less control over the dollar. And Spain could be next.

As if the political crisis in Italy weren’t enough, in Spain, Prime Minister Mariano Rajoy could lose his seat in a tense confidence vote amid allegations of corruption.

His resignation or a vote of no-confidence would inevitably lead to fresh elections there, subjecting the euro to more electoral scrutiny and popular anger.

Meanwhile, President Trump will continue to pursue enforcing restrictions on trade and investment at China’s expense, including the possible adoption of duties on some $50.0 billion of Chinese products. (Source: “White House says it will unveil list of $50 billion worth of Chinese goods that will be subject to a 25% tariff,” CNBC, May 30, 2018.)

In such a context, the dollar is too high.

To gain in competitiveness, a lower dollar helps U.S. exports and makes imports more expensive without having to enforce duties. A high dollar also discourages travel to the United States, which in the summer season, is especially troublesome.